Not for Individual Investors or General Public

This platform is designed exclusively for licensed financial advisors, wealth managers, and investment professionals evaluating career moves between firms. If you're an individual investor looking for personal financial advice, this tool is not for you.

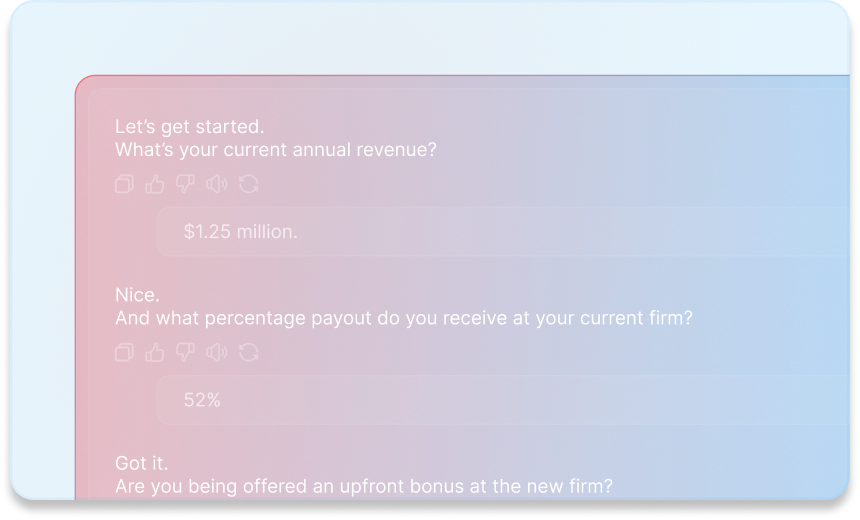

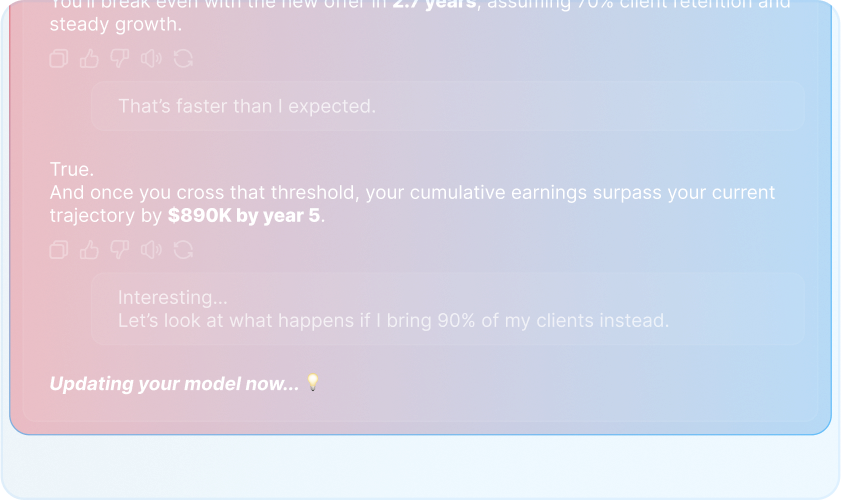

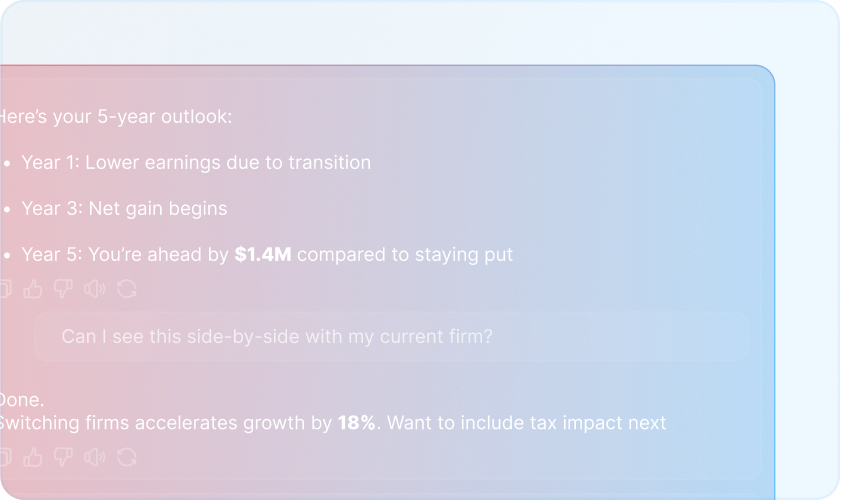

Finally, a tool that understands the complexity of advisor transitions. CompCalc analyzes the metrics that matter most to your practice: T12 performance, payout structures, upfront bonuses, clawback provisions, client retention scenarios, and transition costs. Make data-driven decisions about your career with insights tailored specifically for financial advisors.